Unchained Study Reveals One in Four Americans Own Bitcoin

Business Wire Nov 29, 2023 23:28- Unchained study estimates that 86M Americans own bitcoin, 26% of the total population

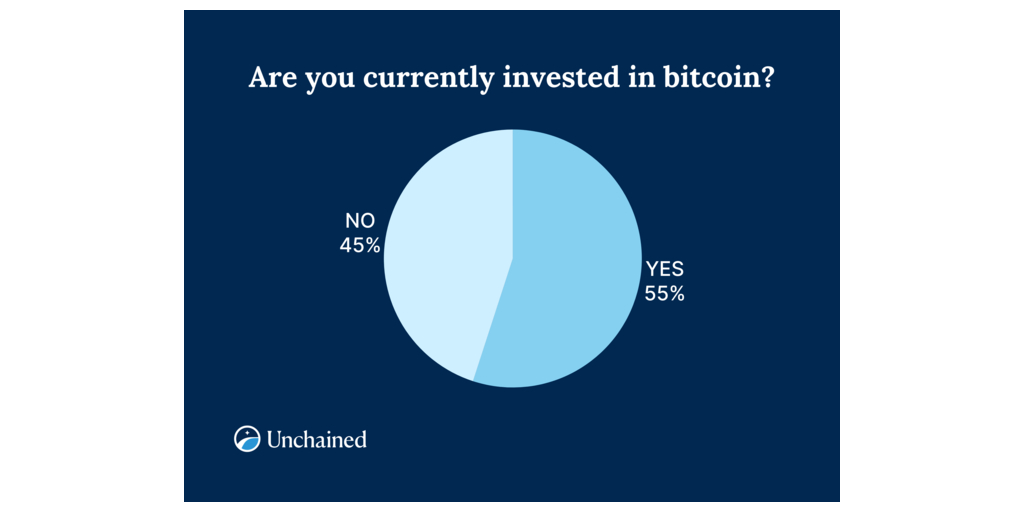

- 55% of US investors surveyed by Unchained report owning bitcoin

- New regulation, bitcoin spot ETF approval, and a US recession are the factors most likely to make US investors buy BTC next year

- One-third of US investors expect bitcoin to outperform gold, cash, and the S&P 500 in 2024

AUSTIN, Texas--(BUSINESS WIRE)--Unchained, the leading bitcoin financial services provider, today published a report with findings from a survey of US investors on bitcoin (BTC) sentiment and outlook for 2024. Chief among the findings is that one in four Americans and 55% of investors surveyed by unchained — defined by Unchained as having at least one investment account — report owning bitcoin, and 95% of this group say they would buy or strongly consider buying more of it in 2024. Of the 45% of respondents who do not own bitcoin, nearly half say they would strongly consider buying it in 2024.

Regulation is poised to be the top catalyst for both bitcoin owners and non-owners in the year ahead. When asked which factor is most likely to make them buy or strongly consider buying bitcoin in 2024, 42% of BTC owners and 35% of non-owners said increased US regulatory clarity around digital assets. Other popular factors include:

- SEC approval of a bitcoin spot ETF — 29% of BTC owners; 13% of non-owners

- US economic recession — 18% of BTC owners; 12% of non-owners

- Guidance from a financial advisor — 6% of BTC owners; 26% of non-owners

Notably, US investors are largely optimistic about bitcoin’s future performance, regardless of whether they own the asset. Most (79%) expect BTC to eventually pass its all-time high of $69,000, despite the asset’s price being down over 50%1 from this during the survey. Over half (55%) of investors predict BTC will reach a new all-time high in 2024, with 28% believing it will be H1 and 26% saying H2 2024. Further, one-third of investors (34%) think BTC will outperform cash, gold, and the S&P 500 in 2024.

The next year is likely to see a rise of bitcoin allocation in retirement portfolios, according to Unchained’s survey results. While nearly half of US bitcoin owners report already having BTC in their retirement account, an additional third (35%) say they would consider adding it to their 401(k), IRA, or other plan in 2024. Among non-bitcoin owners who are open to investing in the asset, 23% say they would consider adding BTC to their retirement account next year.

“At Unchained, we are seeing an influx of bitcoin newcomers who now understand that the asset has longevity,” said Joe Kelly, co-founder and CEO of Unchained. “As reflected in both Unchained’s survey results and the activity of our clients, US investors are eager to gain or expand bitcoin exposure — especially through tax-advantaged vehicles like Unchained’s bitcoin IRA. As more investors look to open or grow their bitcoin positions, Unchained looks forward to serving them whether it be through collaborative custody, the Unchained IRA, our trading desk, or our inheritance solutions.”

With an estimated 158 million Americans owning some type of investment account2, Unchained’s “US Investor Outlook for BTC in 2024” survey sample size of 402 individuals is representative of the US investor population with a 5% margin of error at a 95% confidence level. To qualify for this survey, respondents were required to be permanent residents of the US between the ages of 18 and 78 and self-report as having one or more current financial investment(s). The survey was conducted digitally from October 26 to 28, 2023, during which time the price of bitcoin ranged from $33,610 to $34,9771.

Read the full report on Unchained’s survey of US investor bitcoin sentiment and outlook for 2024 here.

For more information on Unchained, please visit www.unchained.com.

- BTC’s price during the survey ranged between $33,610 and $34,977, according to CoinGecko

- FINRA Investor Education Foundation, “Financial Capability in the United States: Highlights from the FINRA Foundation National Financial Capability Study” (2022)

About Unchained

Founded in 2016, Unchained is a top 10 bitcoin platform by assets secured and has helped thousands of individuals and businesses truly own their wealth by holding bitcoin keys. Unchained's collaborative custody model allows clients to access financial services while continuing to have the benefits of self-custody, the ultimate consumer protection in these uncertain times. For more information on Unchained, please visit www.unchained.com.

These survey results do not represent the opinions or advice of Unchained Capital, Inc. or its affiliates (collectively “Unchained”), any employees of Unchained, or of any qualified investment advisor. Survey respondents were not qualified investment advisors. No representations are made that any survey methods are accurate or correspond with relevant industry practice. Do not make financial decisions based upon the results of this survey, and instead consult with a qualified investment advisor of your choice.

Contacts

Larissa Bundziak

larissa@unchained.com